HIGHLIGHTS

- What is Metaverse?

- Why transactions are booming in Metaverse?

- Is De-Fi the next Bank?

- Will there be a crypto future in FD’s?

- Will Crypto ETF’s give rise to a new market segment?

- How will DAO’s be the killer for Hedge Funds and Corporate Structure in Metaverse?

- From metaverse and fintech to Finverse?

- The Money in Metaverse is Financing in it

- Mortgaging in Metaverse- a new lending system?

“The success of building and scaling in the metaverse is dependent on having a robust and flexible financial ecosystem that will allow users to seamlessly connect between the physical and virtual worlds.”

What exactly is Metaverse?

Metaverse is one of the hottest topics. Its synchronization with finance and tech makes it a crucial and dominating upcoming field. Meta-Verse means “beyond virtual experience”. So, the proliferation of the Metaverse is taken into consideration as a subsequent unstoppable improvement in tech, as tens of thousands and thousands of greenbacks are being injected into the digital studies and infrastructure, and steady incentives for innovation and opposition within the market. The meta-universe is a creation of new-age digital companies, wherein there are matters much like what we’ve within the normal companies, a well-functioning economy, and locations wherein we will visit speak with others. This is a shared digital international company wherein you could purchase and promote land, buildings, avatars, or even names, generally the usage of virtual currency. In this global universe, customers can buy and get admission to virtual merchandise on any virtual platform of their choice. Today, the Apple App Store or Google Play is the nearest digital platform to us, wherein you could purchase numerous virtual merchandise and use them on more than one structure.

To create Metaverse offerings that clients can accept as true and which line up with their ideals, corporations need to use it wisely, analyzing anticipated commercial enterprise effects at the same time as coping with its environmental impact. This needs to encompass every degree of its rollout, from method and layout to engineering and implementation.

It’s far believed that monetary facts control and monetary transaction control that in shape actual existence supplied with the aid of using monetary era answers may be the maximum critical meta-universe, making meta-universe as critical as the actual existence

But now no longer everybody is so assured that the metaverse and virtual property will evolve to the factor wherein fintech corporations will want to manipulate, promote, or in any other case manipulate them.

Why transactions are booming in Metaverse?

While the innovation fans, gaming structures, and social media are busy speaking about the development in the Metaverse, increasingly different game enthusiasts are taking note of different virtual opportunities and are keen to locate new approaches to make cash and promote goods in the digital economy. In only some weeks, Metaverse has now no longer most effective end up the brand new preferred of big era corporations, however additionally the brand new preferred of the funding industry. Metaverse is now seeing a boom in big-era corporations which indeed is creating a brand value for their company.

As we can see from the data below, the cryptocurrency value has increased more than 5x, 10x, and some even 100x. As per Forbes data, the price of virtual lands has increased more than 700%. As virtual real estates sales are skyrocketing, Sandbox is the largest virtual world in terms of transactions volumes, with roughly around 65,000 transactions, leading to virtual land totaling $350 million in 2021. Decentraland became the second-largest virtual world seeing 21,000 real estate transactions worth $110 million in 2021. NFT world an online open NFT marketplace portal has also seen a tremendous amount of gross transaction in the year 2021.

Is DeFi the next Bank?

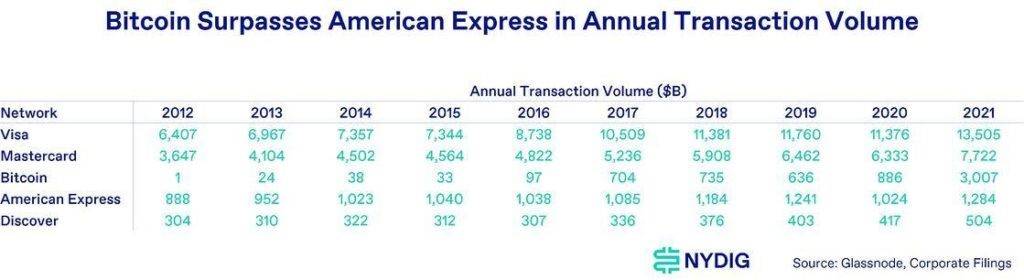

The idea of digitalized banks changed the ecosystem of the current finance system, showing the orthodoxies of the current banking system. “Defi will rule the metaverse”- which will end the lagging banking system. As the day-by-day transaction of Bitcoin has crossed over $3 Trillion last year, it has already crossed the transaction rates of two major credit card players, and hope for crypto believers is that it will surely overcome the other major players within the next 5 years.

Will there be a crypto future in FDs?

As Indians love fixed deposits(FD), Vauld (a crypto exchange) initiated and created the most lovable thing for Indians but in a cryptocurrency called “Crypto FDs”. Entire Indian market as well as other foreign crypto markets amazed by this innovation. The rate of interest was far better than the traditional banks. So this created a movement for people to invest more in cryptos.

Will Crypto ETFs give rise to a new market segment?

ETF, a single or basket of security started trading launched in 1993 in the US and this also created an initiative among the Exchanges to create crypto ETF.

These are some of the ETFs which are traded excessively. This has led to another crypto market segmentation in Metaverse

How will DAOs be the killer for Hedge Funds and Corporate Structure in the Metaverse?

DAOs (Decentralized Autonomous organizations) are organizations that aim to change the centralized structure like the board of directors, chairman, etc. No one person or entity governs them. The rules of governance and operations are codified in smart contracts saved in the blockchain, which means they cannot be changed without a vote of all a DAO’s members. These are not physical organizations but they rather meet on virtual platforms like discords, Reddit, etc. The decision-making power is proportional to the number of tokens a person owns by purchasing it with cryptocurrency. ConstitutionDao raised tens of millions of dollars to buy the rare version of the U.S. Constitution and won against Hedge Fund Manager Ken Griffin, which shows the power of DAOs.

From metaverse and fintech to Finverse?

In the digital companies of the metaverse, the funding by current fortune 500 companies has modified the ideas of the game. It is sort of improbable for banks and different traditional economic foundations to stay aggressive through each one of the cycles that require rapid transformation and innovative arrangements. It moreover looks like it will likely be tough for them to stay aggressive if they don`t make important investments in the latest upcoming virtual assets as soon as possible. Working collectively with fintech and taking advantage of fintech improvements to have a presence on this new-age digital companies may be the fastest change manner to have a sizable presence withinside the meta international.

The Money in Metaverse is Financing in it

Supply and demand dynamics are driving people into the meta-economy. Over time, the market for metaverse real estate could evolve in a similar way as the real estate market in the analog world. In time, the virtual real estate market could start seeing services much like in the physical world, including credit, mortgages, and rental agreements. For both virtual worlds, the average investment in land was about $5,300, but prices have grown considerably from an average of $100 per land in January 2021 to $15,000 in December 2021, with rapid growth in the fourth quarter when the Sandbox Alpha was released.

Mortgaging in Metaverse- a new lending system?

As the need for money arises constantly, mortgaging in the metaverse is a brand new concept. Recently, TerraZero Technologies issued one of the first-ever mortgages in the metaverse, a network of virtual worlds where users can interact, experience entertainment, and trade. The tech firm issued the two-year mortgage with an undisclosed down payment and interest rate for a $45,000 parcel of land in Decentraland, a metaverse with approximately 92,000 parcels, as per TerraZero’s report. The firm followed a traditional real estate mortgage vetting process, self-financed the purchase and today holds the NFT, or non-fungible token to securitize the mortgaged land. This gives rise to a new generation of led transaction systems which can change the future potential outcomes for mortgaging.

Conclusion

Metaverse is one of the greatest tools for common people to make the most money and to step into the world of fame. New opportunities are emerging daily, giving rise to various possible outcomes in the future for finance in Metaverse. As innovation has surged leading to a new age DAO, ETFs, FD’s in cryptocurrency, and mortgaging which in turn gives the finance sector a boost. Metaverse has a lot of potential to bring changes in the lives of billions of people leading to a futuristic concept of decentralization.

Blackcoffer Insights 39: Jay Oza, K. J. Somaiya Institute of Engineering and Information Technology